Trade Breakdown and Trading Advice for the European Currency

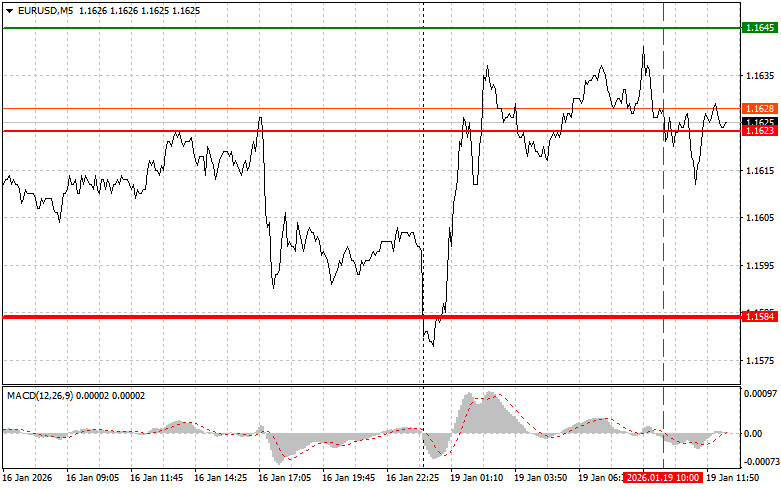

The test of the 1.1623 price level occurred at a moment when the MACD indicator had already moved significantly downward from the zero line, which limited the pair's downward potential—especially within the context of the bullish Asian session move.

The report on consumer price growth in the eurozone countries made no impression on traders. The headline figure fell to 1.9%, while core inflation remained unchanged at 2.3%. Maintaining inflation at these levels is unlikely to push the ECB toward more aggressive interest rate cuts. Going forward, the main factor influencing the euro exchange rate will be geopolitical shocks, as the ECB does not intend to intervene in current developments for now.

Further, due to the absence of US economic data in the second half of the day, the main focus of attention will be Trump's next steps regarding the European Union and Greenland. Despite the lack of macroeconomic statistics, markets always react sharply to geopolitical events, especially to any impulsive actions by the US administration. Moreover, recent discussions about the potential purchase of Greenland have triggered a wave of criticism and confusion. Even if the probability of such a deal is extremely low, such statements create an atmosphere of instability and add an element of unpredictability to US policy. This, in turn, affects the stability of the US dollar and forces investors to seek alternative assets.

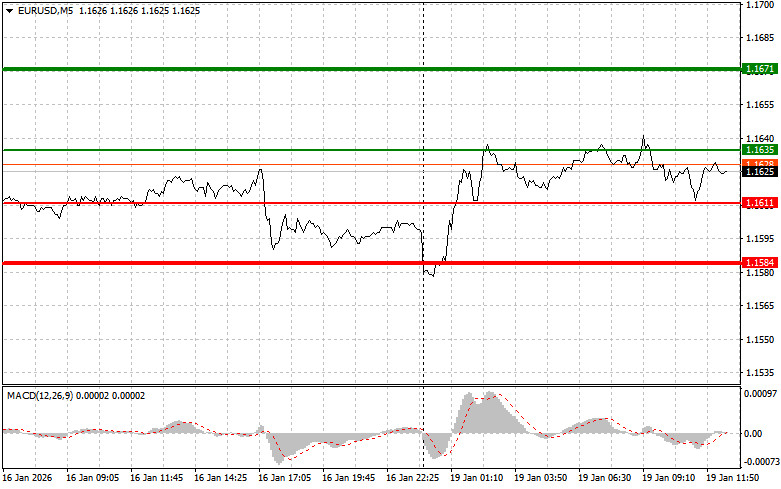

As for the intraday strategy, I will rely more on the implementation of Scenarios No. 1 and No. 2.

Buy Signal

Scenario No. 1:

Today, buying the euro is possible when the price reaches the 1.1635 level (green line on the chart), with a growth target at 1.1671. At 1.1671, I plan to exit the market and also sell the euro in the opposite direction, aiming for a 30–35 point move from the entry point. Further strong growth in the euro can also be expected.Important: Before buying, make sure that the MACD indicator is above the zero line and is just beginning to rise from it.

Scenario No. 2:

I also plan to buy the euro today in the event of two consecutive tests of the 1.1611 price level when the MACD indicator is in the oversold area. This will limit the pair's downward potential and lead to a reversal upward. Growth toward the opposite levels 1.1635 and 1.1671 can be expected.

Sell Signal

Scenario No. 1:

I plan to sell the euro after the price reaches the 1.1611 level (red line on the chart). The target will be 1.1584, where I plan to exit the market and immediately buy in the opposite direction, aiming for a 20–25 point move from that level. Pressure on the pair will return if Trump abandons the Greenland idea and trade tariffs.Important: Before selling, make sure that the MACD indicator is below the zero line and is just beginning to decline from it.

Scenario No. 2:

I also plan to sell the euro today in the event of two consecutive tests of the 1.1635 price level when the MACD indicator is in the overbought area. This will limit the pair's upward potential and lead to a downward market reversal. A decline toward the opposite levels 1.1611 and 1.1584 can be expected.

What's on the Chart:

- Thin green line – entry price for buying the trading instrument

- Thick green line – estimated price where Take Profit can be set or profits can be taken manually, as further growth above this level is unlikely

- Thin red line – entry price for selling the trading instrument

- Thick red line – estimated price where Take Profit can be set or profits can be taken manually, as further decline below this level is unlikely

- MACD indicator – when entering the market, it is important to rely on overbought and oversold zones

Important:

Beginner Forex traders must be very cautious when making market entry decisions. Before the release of major fundamental reports, it is best to stay out of the market to avoid being caught in sharp price fluctuations. If you decide to trade during news releases, always place stop orders to minimize losses. Without stop orders, you can lose your entire deposit very quickly—especially if you do not use money management and trade large volumes.

And remember, successful trading requires a clear trading plan, like the one presented above. Spontaneous trading decisions based solely on the current market situation are an inherently losing strategy for an intraday trader.