The GBP/USD currency pair also traded quite calmly on Monday, despite a small decline in the US dollar. However, we are not waiting for a "small decline in the dollar" but rather a very large one. The market continues to ignore much of the news flow, and nothing can be done about that. But the news backdrop does not become "neutral," "boring", or "in favor of the US currency" because of that. Over the weekend, Donald Trump announced tariff increases for Germany, Sweden, Norway, Denmark, France, Finland, the United Kingdom and the Netherlands. According to Trump, America subsidized Denmark for many years without charging it any payments or tariffs, so Copenhagen must repay the debt by providing the largest island on the planet. Just like that.

The controversial Republican president also said that the security of the entire world depends precisely on the island of Greenland, which in recent decades has not performed any geopolitical functions. But Trump believes that Russia or China (who also have never voiced claims to this territory) may try to seize the island, and Denmark and the entire EU will be unable to oppose this. Therefore, Washington is "ready to take on the burden of protecting" the Atlantic region and, in fact, Europe itself. But for that to happen, Greenland must become part of the USA. Recall that previously, Trump made a similar "generous" proposal to Canada, considering it his territory.

The new tariffs for the traitor countries will be 10%, but we are sure this is only the beginning of a new round of the trade war. One must understand that tariffs are an instrument of pressure for Trump, a means to achieve his goal. If 10% tariffs do not work, Trump will raise them to 50%, regardless of existing trade agreements. And so on indefinitely. Europe and Britain are already developing packages of retaliatory trade measures and may, at least in 2026, realize that a trade deal with Trump guarantees nothing. Yesterday — universal injustice towards America, today — Greenland, tomorrow — Spain, Italy or Greece, which are "inherently American lands" or allegedly owe America for the next 500 years.

It should also be noted that London and Brussels actually have the means to respond to Trump. Britain remains one of the world's largest financial centers; the European Union is a vast and wealthy territory. Europe is already considering imposing tariffs on US goods worth nearly $100 billion. In addition, activation of the anti-coercion mechanism is actively discussed in Europe, which implies limits on investment and export of services. The blow could fall on US tech companies. However, EU countries again demonstrate their softness, as the vast majority aim to maintain dialogue with Donald Trump and resolve the issue peacefully. It is unclear to us how to solve the problem peacefully, but if Europe and Britain again prefer to negotiate rather than act on the "an eye for an eye" principle, Greenland will not be the end of it.

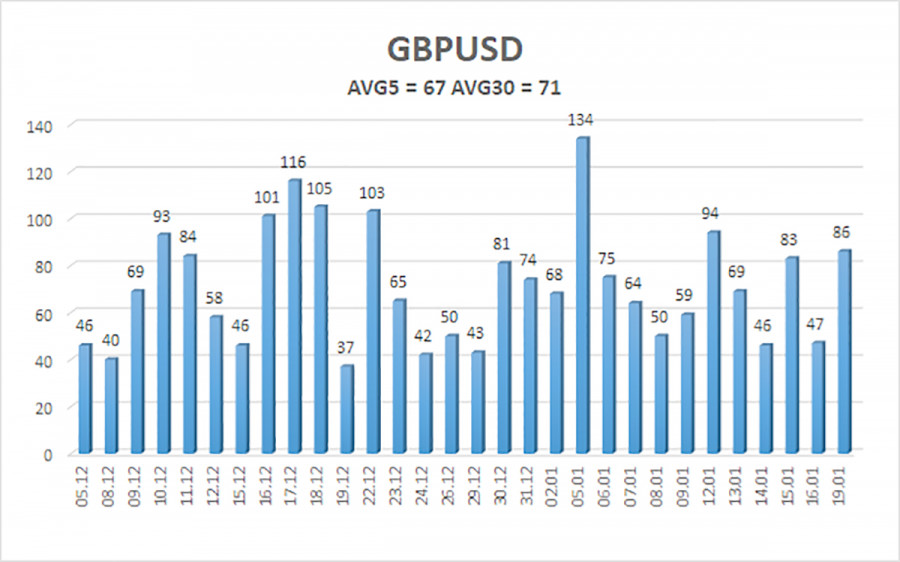

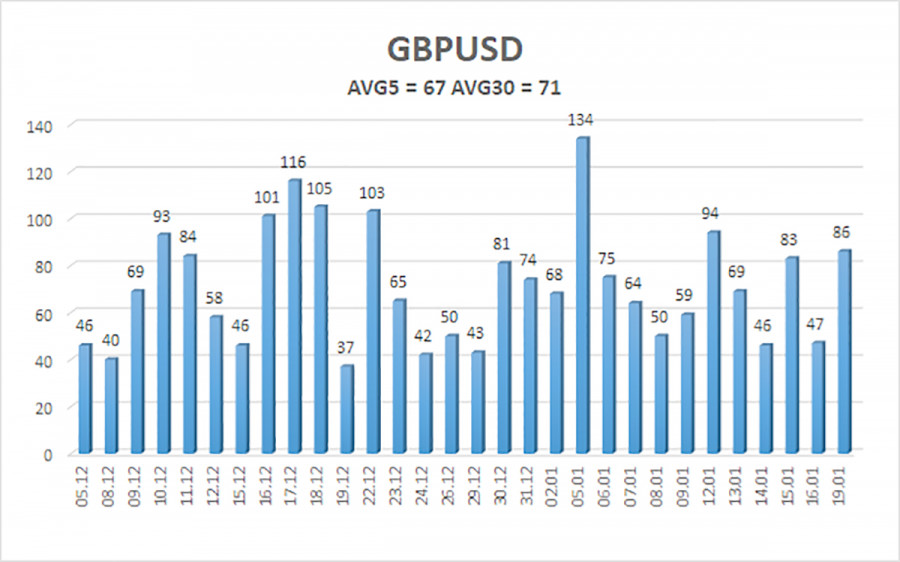

Average volatility of the GBP/USD pair over the last 5 trading days is 67 pips. For the pound/dollar, this value is "medium." On Tuesday, January 20, we therefore expect movement within the range of 1.3360 to 1.3494. The higher linear regression channel has turned upward, indicating a trend recovery. The CCI indicator has entered the oversold area 6 times over recent months and has formed numerous "bullish" divergences, which have consistently warned traders of a continuation of the uptrend.

Nearest support levels:

S1 – 1.3306

S2 – 1.3184

S3 – 1.3062

Nearest resistance levels:

R1 – 1.3428

R2 – 1.3550

R3 – 1.3672

Trading recommendations:

The GBP/USD pair is attempting to resume the 2025 uptrend, and its long-term prospects have not changed. Donald Trump's policy will continue to pressure the US economy, so we do not expect the US currency to strengthen. Thus, long positions with targets at 1.3550 and 1.3672 remain relevant in the near term as long as the price stays above the moving average. Price located below the moving average line allows considering small shorts with targets of 1.3360 and 1.3306 on technical grounds. From time to time, the US currency shows corrections (on a global scale), but for a trend to strengthen, it needs global positive factors.

Explanations of the illustrations:

- Linear regression channels help determine the current trend. If both are directed the same way, the trend is strong.

- The moving average line (settings 20,0, smoothed) indicates the short-term trend and the direction in which trading should proceed.

- Murray levels are target levels for moves and corrections.

- Volatility levels (red lines) indicate the likely price channel in which the pair will trade over the next 24 hours based on current volatility.

- CCI indicator — its entry into oversold territory (below -250) or overbought territory (above +250) signals an approaching trend reversal.